Portfolio Management and Resource Prioritization for Global Business Growth

Strategy and Value Creation

We performed the strategic portfolio management and analysis based on the growth, profit and ROI of global business cells. It resulted in identifying the stronger cells that needed acceleration and the weaker cells that needed remedial actions. This analysis is the key to global business strategy formulation and resource prioritization for higher value addition at group level. Alternatively, we applied the adapted analysis for “Go to Market” prioritization and “Sustainability” materiality and impact for individual enterprise in different industries (Swiss supply chain traceability scaleup, Global Food Strategic Business Unit)

Competencies

- Business Strategy

- Value Creation

- Category Management

- Strategic Portfolio Management

- Resource Allocation prioritization

Context: New Reality requiring Making Choices

(Incl. Acceleration for Immediate Choices Post Covid-19)

(Why & What ?)

- Volatile geo-political Environment

- Consumer Trends/ Demographics

- Competitive Intensity

- Environment & Sustainability Imperatives

- Multi-Market/ Multi-Businesses

- Challenges to Growth & Profitability

- Working and Fixed Capital Efficiency

(How ?)

- Category and Brand Purpose, Strategy

- Long term Value Creation

- Strategic Portfolio Management

- ESG and Sustainability Strategy

- Impact & Innovation Partners

- Investor Communication and Guidance

- Annual Targets Alignment

Objective: Review of Businesses to define Portfolio Priorities and Action plans

Strategic Criteria

- Strategic Fit

- Ability to Win

- Resource Intensity

- Sustainability (ESG)

Strategic Criteria

- Accelerate

- Protect/ Regain

- Invest/ Seed

- Fix/ Harvest/ Divest

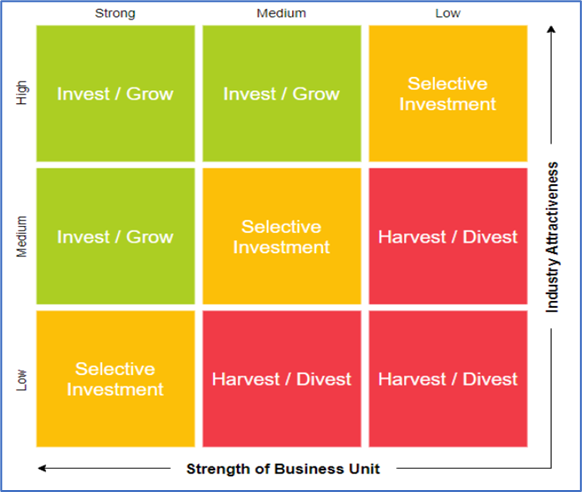

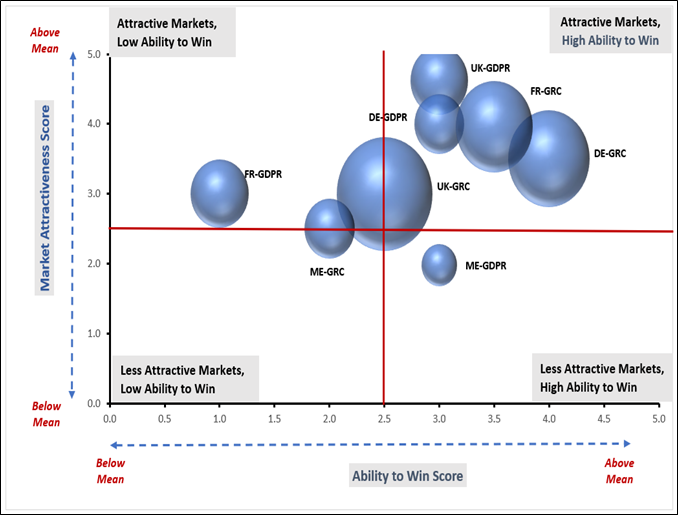

Framework to Make Strategic Choices

(Assessment based on Market Attractiveness and Ability to Win)

Assessment based on weightage of scores on following parameters:

Industry Attractiveness Scores

- Market Size

- Market Growth

- Qualitative Factors (New Trends, ESG)

Business Strength Scores

- Growth & Mkt Share (Own vs Market)

- Competition

- EBITDA

- Sustainability Value Proposition

Source: GE McKinsey 9-Box Matrix for Portfolio Analysis

Combination of Country and Product as Unique Business Cells to be prioritized for GTM expansion strategy

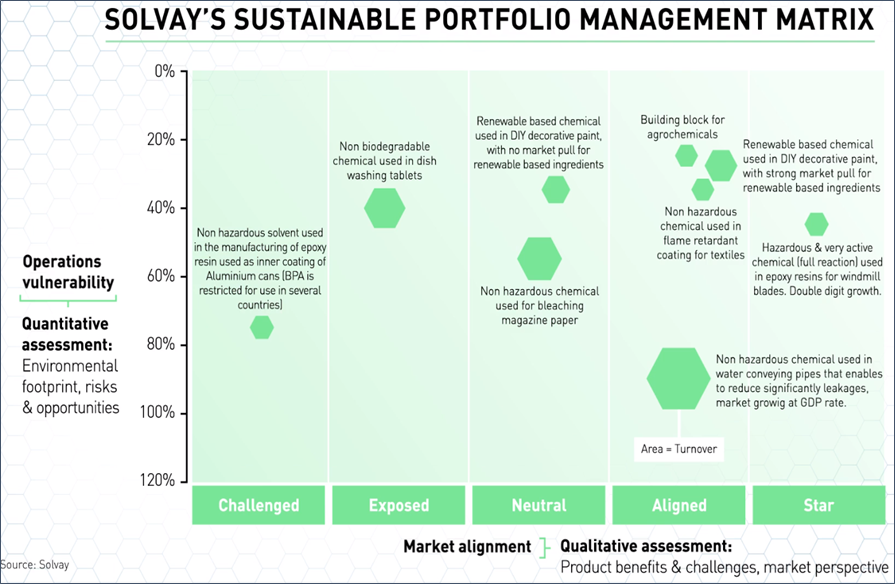

Framework to Make Sustainable Portfolio Strategic Choices

(Assessment based on Operations Vulnerability and Market Alignment)

Combination of Country and Product as Unique Business Cells to be prioritized for Sustainable Strategy and Action plan

Assessment based on weightage of scores on following parameters:

Operations Vulnerability Scores

(Quantitative)

- Environmental footprint

- Risks and Opportunities

Market Alignment Scores

(Qualitative)

- Product benefits and challenges

- Market perspective

Source: Solvay’s Sustainable Matrix for Portfolio Analysis